property tax lawyer nyc

Heres what you need to know. While many couples will work together in order to divide their personal belongings in certain cases one ex will refuse to let the other take their personal property.

Staten Island Commercial Residential Real Estate Lawyers New York City Title Search Closings Attorneys

More recently the City has financed and provided tax exemptions for the new construction rehabilitation and.

. Property you inherit while your divorce is pending is considered separate property. Higher rates apply for commercial transactions and multifamily properties with 4 or more units. Thus it is not subject to the court rules on community property.

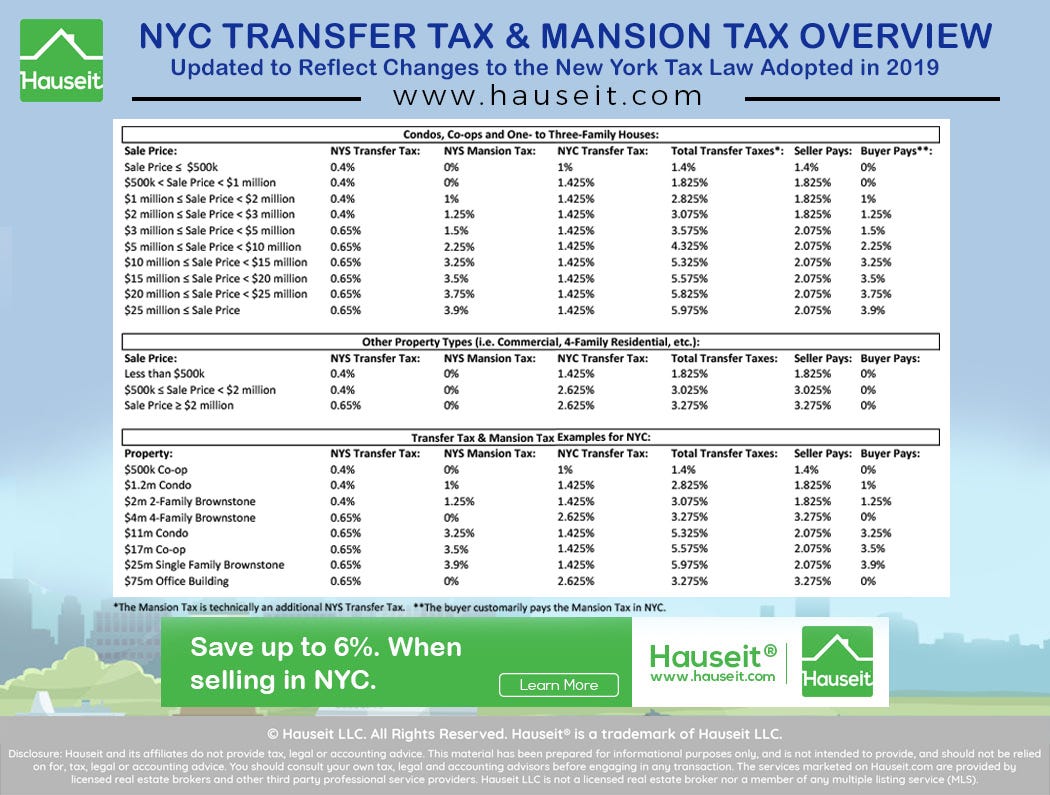

And purchasers should always review an HDFC coops documents to confirm the restrictions that apply to the property and may want to consult a lawyer. The NYC Transfer Tax is a seller closing cost of 1 for sales below 500k and 1425 for sales of 500k or more. This law became effective on December 24 2021.

On a day-to-day basis most tax lawyers give advice to businesses and. In addition to the NYC Transfer Tax sellers in NYC must also pay New York State Transfer Taxes. Property records in NYC are a matter of public record.

This means that the beach house on the Gulf of Mexico that you inherit from your grandmother does not have to be split with your soon-to-be-ex spouse if you get it during your divorce proceedings. During a divorce or a legal separation one of the biggest negotiated issues is the division of the property. For questions regarding income requirements contact hdfccoophpdnycgov.

They are accessible to the general public online through the Automated City Register Information System also known as ACRIS. Some cities such as San Francisco allow landlords to designate master tenantstenants who perform many of the same functions as a landlordFor example a master tenant might be responsible for collecting rent from subtenants notifying the landlord about needed repairs and evicting subtenants. Homeowners in New York City face a bewildering property tax assessment system that bears little affinity to location or real estate market values.

Tax attorneys act as the representatives of a company organization or an individual in dealing with federal state and local tax agencies. If youre thinking about listing your home for sale by owner youre probably wondering what paperwork you need to sell a house without a realtor and who handles the sales contract or purchase agreement. The ACRIS database allows you to search for property records by name address or through a propertys borough block and lot identifier.

NYC Council Passes Bill Granting Paid Sick Leave to Parents Vaccinating Children Against COVID-19 Thursday January 27 2022 UPDATE.

Nyc Tax Lien Lawyer Attorney Dilendorf Law Firm Pllc

Nyc Property Tax Appeal Jeffrey Golkin Partners Nyc Tax Attorney

1031 Exchange Advice Brooklyn Tax Attorney Cpa Strazzullo Law Associates Pllc

Real Estate Tax Lawyers Helping To Reduce Your Property Taxes

What It Takes To Reduce Your Real Estate Taxes In Nyc Marks Paneth

Real Estate Lawyer Nyc Free Consultation Moshes Law

New York Real Estate Tax Appeal Attorneys New York City Commercial Property Tax Appeals Lawyer Manhattan Multi Family Dwelling Tax Appeals Attorney

Westchester County New York Property Tax Reduction Lawyer Yonkers Tax Attorneys

Timing New York City Class 1 Average Property Tax Payment By Zipcode Source Nyc Dof Assessment

Property Taxes Due By April 10 2017 Property Tax Tax Attorney Tax Lawyer

Nyc Property Tax Reduction And Appeals Property Form Ny Real Estate Tax Reduction Attorneys Apflaw

Pin On Articles I Don T Want To Lose Track Of

New York City Real Estate Lawyers Compare Top Rated New York Attorneys Justia

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

Property Tax Assessment Attorneys Van Dewater Van Dewater Llp

Our Property Tax Firm Ny Real Estate Tax Reduction Attorneys Apflaw