where does your credit score start canada

For example Canadian credit scores range from 300-900 while US credit scores range from 300-850. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit.

Credit Score Range What Is The Credit Score Range In Canada

Lenders use it to determine.

. Learn more about how your credit. How to Check Your Credit Score. Ideally you and your ex-spouse can figure out how to divide up the debt that was built while you shared a.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card. While both share FICOs common credit score model the average credit score in Canada. If youre not sure what your credit score is its easy to find.

Contrary to popular belief. In Canada credit scores range from 300 just getting started up to 900 points which is the best score. Your credit score comes from the information in your credit report.

Your credit score is a number between 300 and 900 that tells lenders in Canada how. Last Updated on September 16 2022 by SnappyRates Team. Its essential to keep your score on the high end of the scale but where do you start.

The BMO CashBack Mastercard for students is a no fee credit card designed specifically for students that puts you in control and lets you choose when you receive your. Credit scores start at 300. Multiple hard inquiries within a short time indicate greater risk and can hurt your credit score.

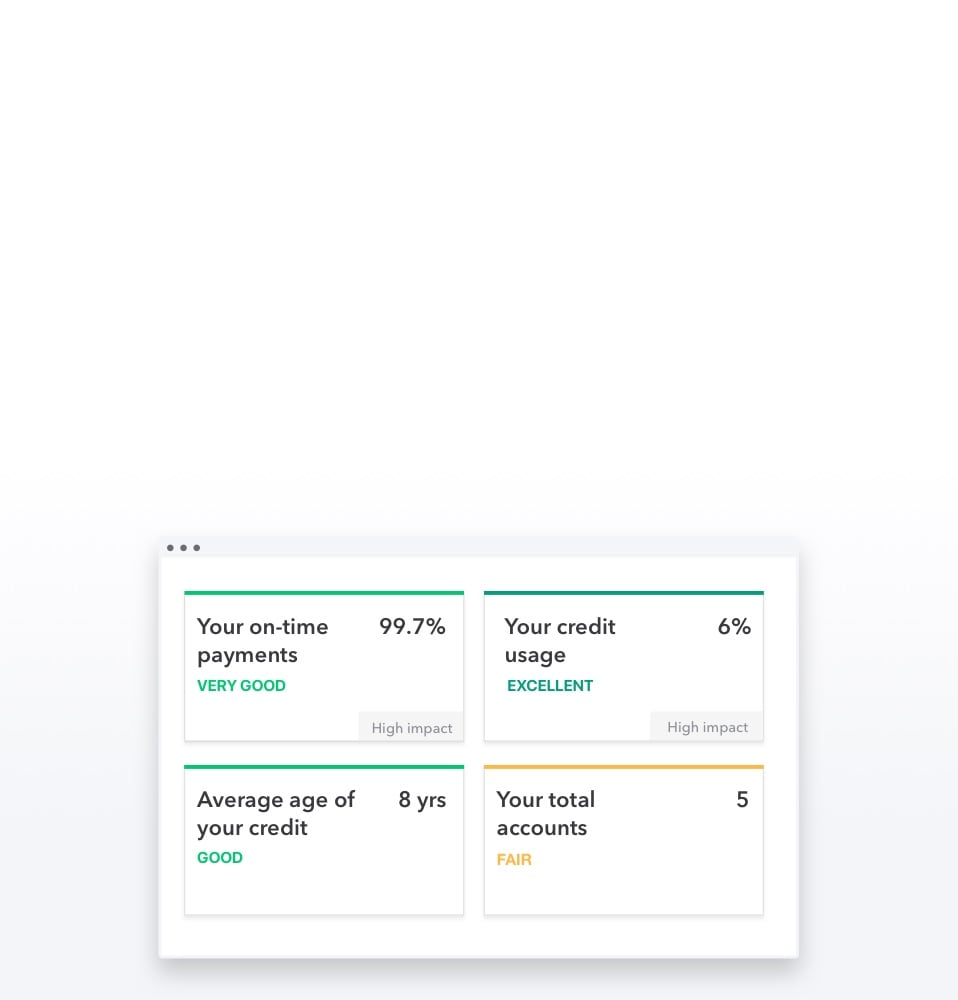

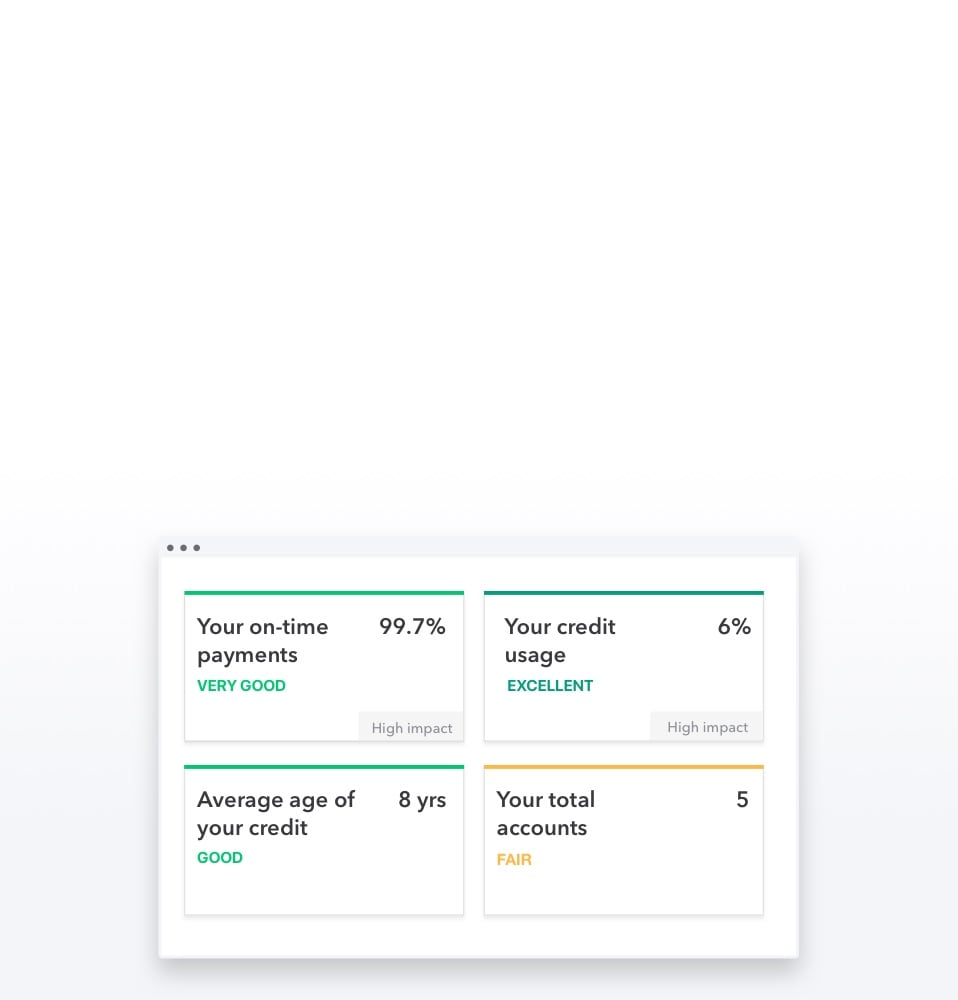

Most peoples credit score doesnt start at the. It shows how well you manage credit and how risky it would be for a lender. Plus payment activity is reported to the 3 credit bureaus Equifax Experian and TransUnion to build your credit.

In Canada credit scores can be as high as 900 and as low as 300 but dont worry. Its essential to keep your score on the high end of the scale but where do you start. On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a little over 740.

Get your credit score. In Canada you will get credit scores as high as 900 points as a simple starting point. Both Wise and Postmedia collect a commission on sales through the links on this page.

Take advantage of this loan product for only 1999 per. Your credit score is a three-digit number that comes from the information in your credit report. It will slowly improve based on your financial performance.

In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a. In TransUnions view a score that is above 650 will likely allow you to receive a standard. At the age of 18 you start your credit score with 300 when you get a job a loan or a credit card.

Since credit scores range from 300 850 300 could be considered the starting score. It shows how risky it would be for a lender to lend you money. A credit score in Canada is a three-digit number that ranges from 300 to 900 points.

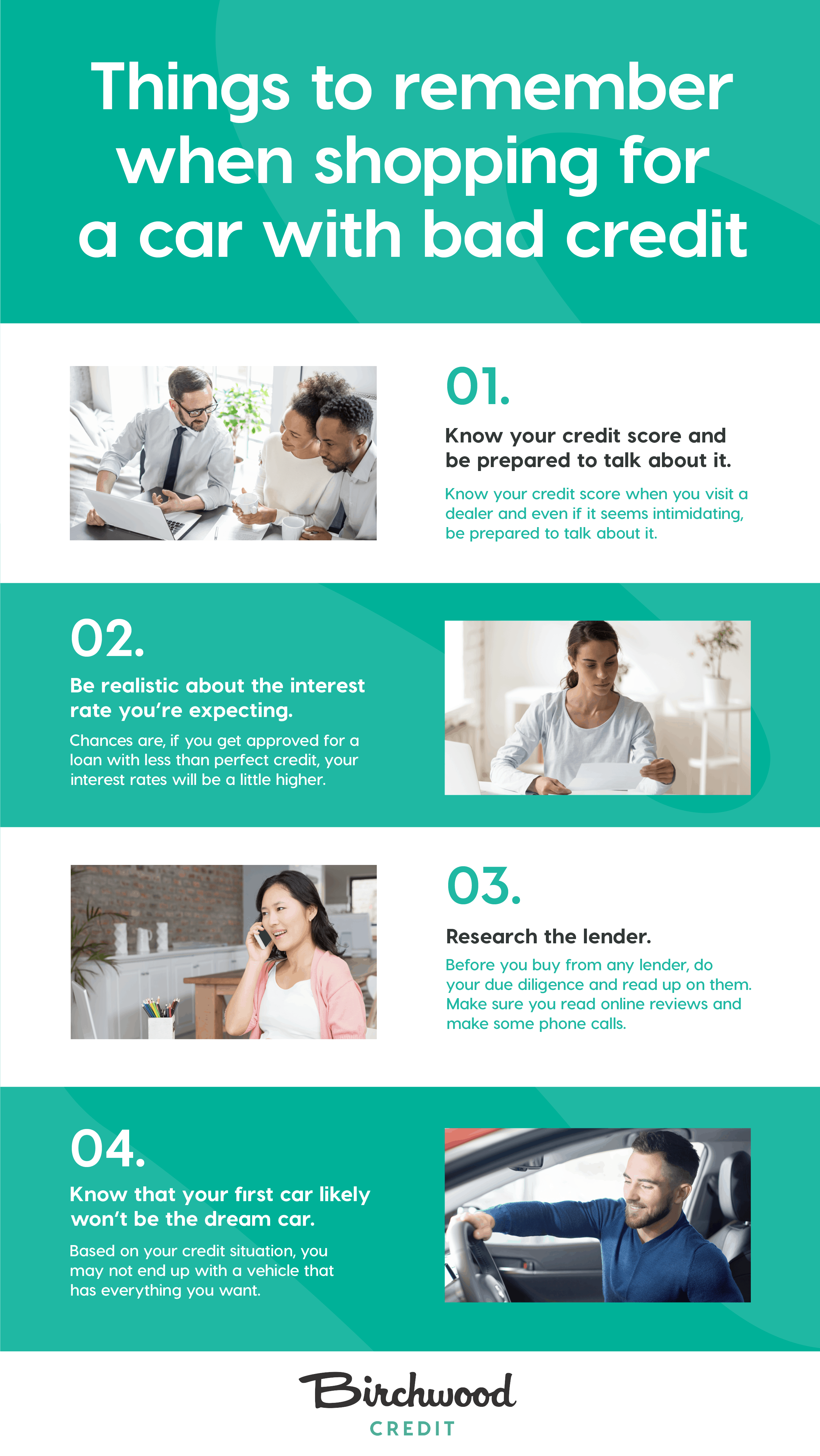

This usually happens within six months. According to TransUnion 650 is the magic middle number a score above 650 will. 4 tips to rebuild your credit score after a divorce.

However the starting credit score isnt zero. If youve never had credit activity a credit card or loan or instance you wont start at 300. Resolve join debts and pay it off.

Once youve opened a line of credit typically your first credit card your credit score will begin to be calculated.

:max_bytes(150000):strip_icc()/how-long-it-takes-to-build-good-credit-4767654_final-5b370f861f4f42e5975e63c6bbeb2784.gif)

How Long It Takes To Build Good Credit

How To Improve Your Credit Score 10 Step Guide Canada For Newbies

How To Improve Your Credit Score Manitoulin Chrysler Limited

Free Credit Score Free Credit Report With No Credit Card Mint

What Is A Good Credit Score In Canada

7 Ways To Boost Your Credit Score Seattle Credit Union

Getting Going How To Wreck Your Credit Score Wsj

8 Simple Ways To Boost Your Credit Rating In Canada Net Worth Update December 2018 1 66 Canadian Budget Binder

Credit And Tax Secrets Canada How To Build Your Credit And Improve Your Credit Score Fast Save Money On Your Corporate Gst Hst Payroll And Personal Tax Mahoni Bashir 9781999273118 Amazon Com Books

Tips On How To Improve Credit Score Equifax

What Is A Good Credit Score In Canada And How To Improve It

How To Restore Your Credit Credit Restoration Help In Canada My Money Coach

Learn What Is A Good Credit Score In Canada Good Credit Explained

5 Steps To Rebuilding Credit In Canada Credit Counselling Society

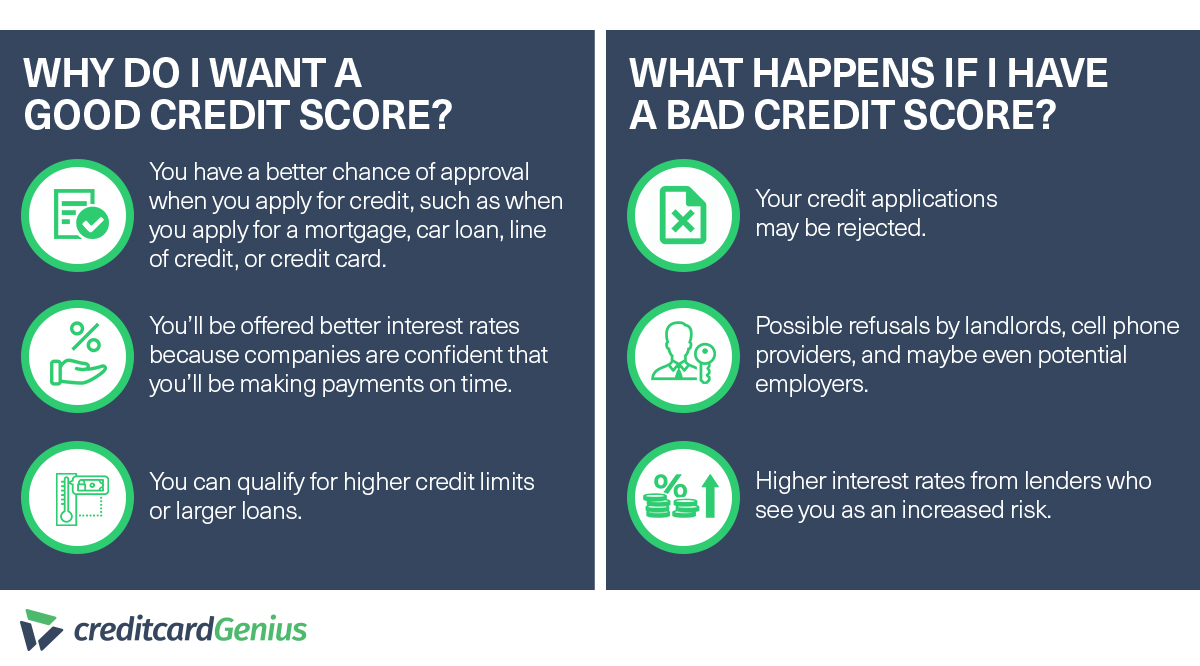

Credit Score In Canada What These 3 Digits Say About You Creditcardgenius

Credit And Tax Secrets Canada How To Build Your Credit And Improve Your Credit Score Fast Save Money On Your Corporate Gst Hst Payroll And Personal Tax Mahoni Bashir 9781999273118 Amazon Com Books

What Is A Good Credit Score Nerdwallet

The Ultimate Guide To Credit Scores In Canada

What S A Good Credit Score Range Do You Know Yours Finder Canada